commercial credit risk benchmarking

ProSight

Credit Risk Navigator,

powered by AFS

Benchmark your performance

The industry’s premier credit risk benchmarking program.

Measuring your commercial loan performance is necessary during any part of the economic cycle, and even more critical during periods of stress. Understand how your portfolio stacks up against peer banks to adjust your strategy for success.

Curated, in-depth data.

Get curated, in-depth data more often, and earlier, than with any other service. The ProSight Credit Risk Navigator (CRN), powered by AFS, is the industry’s next-generation commercial credit risk service. With a one-of-a-kind monthly reporting cadence, extensive data granularity, customizable reporting, and an intuitive dashboard, CRN provides the best commercial credit metrics resource for bank leadership.

Easily benchmark your performance against peers and the market by finding out…

- How your portfolio compares to peers

- Which industries are leading recent trends

- Which sectors have the most historical volatility

- The projected losses for comparable credit

With CRN, you get the tools to access this information on an intuitive online dashboard to help you stay ahead of industry trends.

The difference is in our reporting cadence.

Whether it is stress-testing scenarios, comparing your loan performance with industry benchmarks, or preparing for your next meeting with senior management and the board, Credit Risk Navigator is your companion to stay ahead of the curve.

Dashboards

Easy-to-use dashboards for virtually limitless views.

What if you had one place to access your data? With CRN, you get the tools you need to access the information you need on an intuitive online dashboard. The dashboard provides a variety of views that facilitate standardized peer comparison reporting, customized reports, queries targeted by specific need, and other impromptu analysis prompted by market events, with a granularity that far exceeds other similar services. Here is just a sampling of what you can get and do with the CRN dashboards.

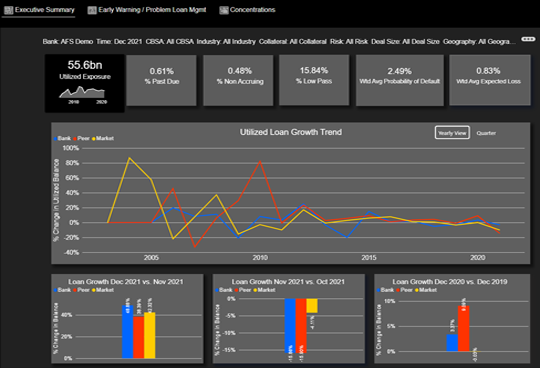

Executive Summary Dashboard

- A concise, informative summary of a bank’s credit performance relative to a self-selected peer group and the broad market.

- Ability to toggle between six KPIs and filter by industry sector, geographic location, and more.

Enables executives and portfolio managers to quickly grasp broad market trends and discern the drivers of a bank’s relative under- or over-performance.

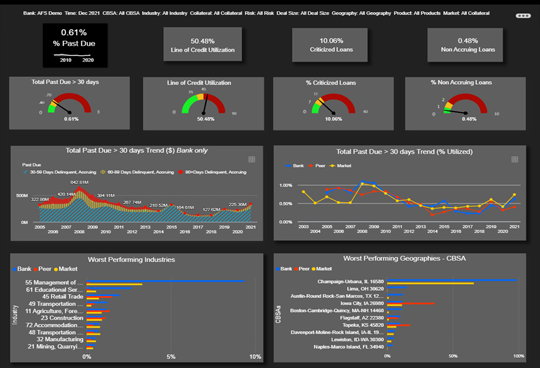

Early Warning/Problem Loan Management Dashboard

- Visual speedometers provide KPI monitoring across the commercial portfolio.

- Auto rankings by industry sector and metropolitan area reveal where problem loans are concentrated.

This dashboard empowers risk managers to resolve credit problems in a timely manner before they mature into larger issues.

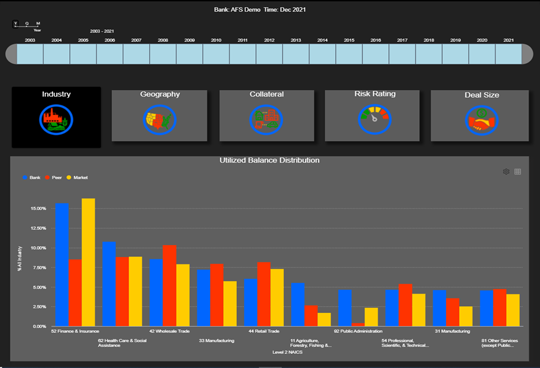

Concentrations Dashboard

-

Illustrates a bank’s commercial loan portfolio composition versus the peer group and the broad market.

Helps reveal where the bank may be an outlier and which concentrations are contributing favorably or unfavorably to the bank’s overall loan growth and credit risk profile.

An overview at a glance.

Industry Insights

Additional insights from industry-recognized experts.

We don’t stop with delivering the industry’s most robust database with easy-to-use dashboards. Each month, we examine CRN’s data during the "Credit Trends in Commercial Lending" webinar, providing a comprehensive overview of key C&I and CRE credit trends and risk metrics.

Get in Touch